Is the cost of living crisis affecting your business? The Times reported that "UK GDP increased by 0.2% from between April and June", however, "the threat of recession still looms". Business survival during this economic crises depends on your ability to adapt quickly. With some savvy strategies and a touch of flexibility, your small business can not only ride out the storm but come out even stronger. In this article, we're diving into some tactics that small businesses can employ to survive and even thrive during economic downturns.

The impact of the cost of living on businesses, encompassing both dwindling profits and escalating expenditures, might appear daunting. However, this article looks at managing expenses, diversifying, managing pricing and other tactics to keep the financial ship steady.

"Small businesses can thrive in a recession if they listen to their customers and pivot quickly - unlike larger corporations who have more procedures in place and are more likely to be risk averse. Often in a recession unexpected opportunities arise, look out for patterns in customer behaviour and jump on them as soon as you can." Rachel Watkyn

1. Cutting your small business costs

The inflation impact on business operations can be severe, with continually increasing expenses. Therefore, in a cost of living crisis, tackling your costs first is crucial.

Begin by scrutinising all of your outgoings. Many small businesses have very few outgoings that can be cut but you may be able to find better prices on:

- Web hosting

- Insurance

- Your accountant

- Postage

- Email packages

Consider consulting your accountant to identify potential tax deductions and cost-saving measures.

2. Evaluate pricing

In a cost of living crisis, it goes without saying that people have less money to spend and this can severely impact your profit.

Instead of immediately dropping prices, consider re-evaluating your market. For example, you could target a higher-end market. Analyse competitors who cater to that market segment and learn from their branding and marketing strategies. From their use of hashtags to their messaging, see if you can apply those elements to your business. Emphasise the unique value and quality of your products to justify maintaining or adjusting your pricing structure.

This strategy won’t work for all businesses but is worth considering for those that sell non-essential products like jewellery and candles. You could also add a higher end/luxury product to your range. Think “Taste the Difference” by Sainsbury’s and "Lexus" made by Toyota.

It is always a good idea to keep on top of your pricing. Read our guide to pricing if your pricing structure needs revisiting.

3. Don't stop spending on marketing your business

During economic downturns, the knee-jerk reaction might be to cut back on marketing expenses. However, studies have shown that businesses that increase their marketing efforts during tough times often fare better in the long run.

There are many famous cases of businesses that have increased their marketing spend during downturns to take advantage of the reduced competition and cheaper advertising prices.

Famous examples include Amazon, who increased marketing when the dot com bubble burst in the early 2000s and Apple, who released the MacBook air during the 2008 financial crisis.

The bottom line is that if you cut out marketing your business, you will fade from people’s minds and they won’t buy from you.

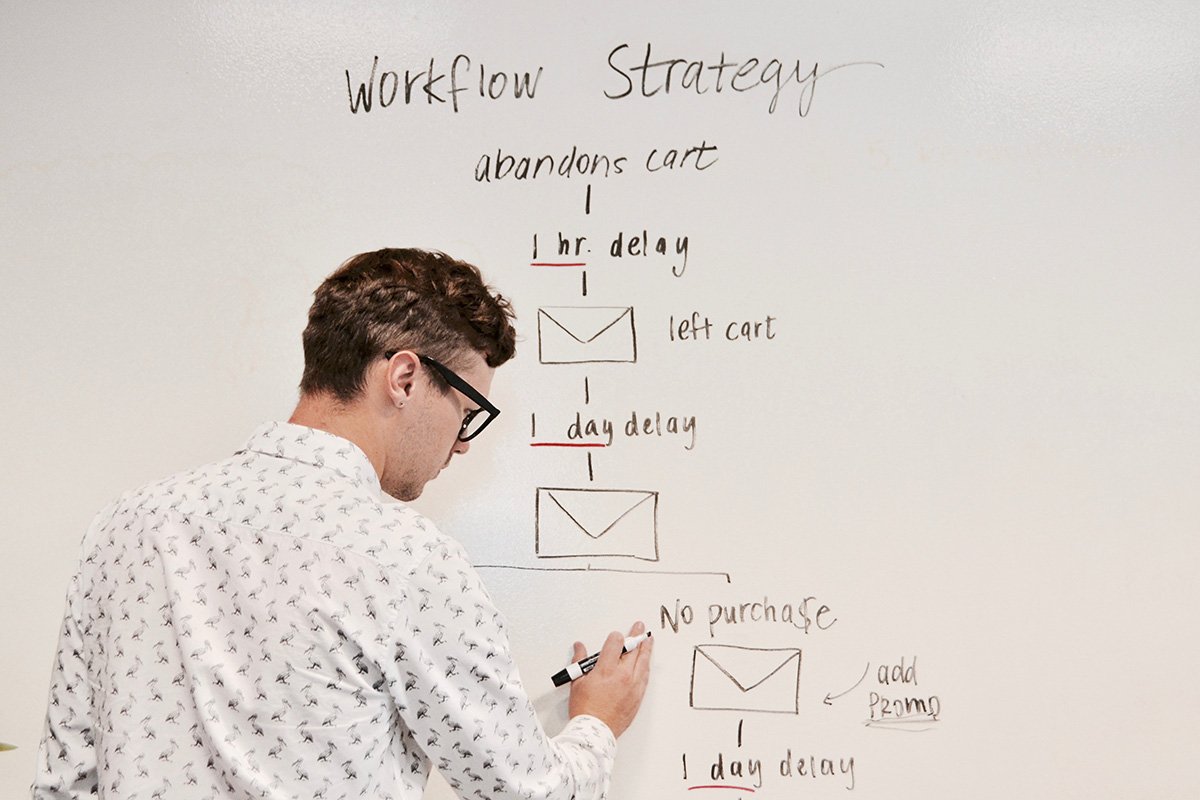

4. Delegate non-core tasks

In a small business, time is a precious resource. During challenging economic periods, your focus should be on sales and marketing.

If you are a solo-preneur, consider hiring a virtual assistant (VA) to handle time-consuming administrative tasks that divert your attention from revenue-generating activities. Yes, it might seem strange that we are recommending that expenditure. However, a VA can manage emails, appointments, data entry, and other routine tasks, enabling you to dedicate more energy to bringing in the money.

5. Diversification

Investigate diversifying your revenue streams for stability.

You are the expert at what you do – can you offer training sessions, workshops, or online courses? Sharing your expertise not only generates income but also positions you as a thought leader.

Maybe your business has physical space that you could consider renting out for events, meetings, or storage.

6. Harness customer loyalty

Your existing customer base is arguably your most valuable asset. In a downturn, your loyal customers can keep you afloat.

Focus on enhancing customer relationships through personalised communication, exceptional customer service and loyalty programs. Engage with customers on social media, ramp up your customer service and gather feedback to continuously improve your products and services.

7. Spring clean your stock

It’s unlikely that all your products are working for you. You may have products that once sold but no longer do. Or perhaps you have products that never sold. Maybe now is the time to have a sale on those products to attract new customers.

Every product has a lifecycle and ideally, you should plan for the different stages of your products’ lifecycles. This includes how you display them on your website and how you promote them. Our Product Lifecyle guide can help you.

Don’t forget that you can ask your customers what products they would like you to sell. Customer feedback is valuable data, especially when money is tight.

8. Adapt and Embrace Change

In times of economic downturn, adaptability is key. Be willing to pivot your business model, explore new markets, or modify your offerings to meet evolving demands. Stay informed about industry trends and consumer behaviours to make informed decisions that position your business for success.

Conclusion

While economic downturns can present formidable challenges, small businesses have the capacity to overcome them through strategic planning and decisive action. By optimising costs, refining products and pricing, investing in marketing, delegating tasks, diversifying revenue streams, nurturing customer relationships, and embracing adaptability, your small business can not only survive but thrive in the face of adversity.

There are many opportunities for your small business during a recession, but it's knowing the areas you need to focus on and action, your small business could meet somebody elses needs that is struggling, its about being clever and thinking of how you can target those needs of consumers.

Remember, with determination and a proactive approach, your business can emerge from economic downturns stronger and more resilient than ever before.

If you're struggling with navigating your business through these challenging times and need some advice, speak to one of our experts with our Tiny Clinic...